Credit card processing fees can quietly erode business profitability, costing U.S. merchants an estimated $172 billion in 2023 alone. If you’re tired of watching profits shrink with every swipe, there’s a compliant, customer-friendly way to keep more of every dollar: a cash discount program.

These programs let you offset processing costs by offering a small discount to customers who pay with cash—boosting margins without raising prices across the board.

At RevUpX, we specialize in helping businesses implement seamless, fully compliant solutions that protect your bottom line. In this guide, we’ll break down how cash discount programs work, how to roll them out effectively, and why they’re becoming a smart play for cost-conscious merchants.

Key Takeaways

- RevUpX delivers easy, compliant implementation: From setup to training, RevUpX handles every step of the cash discount rollout to ensure compliance and ease of use.

- Cash discounting offsets credit card processing fees: Businesses can recover 100% of swipe fees—improving margins without raising listed prices.

- Transparency builds trust and ensures compliance: Clear signage and receipts help customers understand the discount and keep your program compliant with card brand rules.

- Setup is quick and works with your current systems: Most businesses can launch in weeks with little to no IT involvement or operational disruption.

- Ongoing support ensures long-term success: Regular reviews and updates help keep your program optimized and compliant as rules evolve.

What Is a Cash Discount Program?

A cash discount program builds the cost of credit card processing into the listed price and offers a discount to customers who pay with cash or an eligible debit card. Unlike surcharges, which add a fee for card usage, cash discounts subtract a fee for non-card payments.

For example, a listed price of $103.50 includes a 3.5% processing fee. If the customer pays in cash, they receive a discount and pay $100.00. Either way, the merchant keeps the full amount they would’ve received on a card transaction—without absorbing the processing cost.

These programs are legal in all 50 states, provided that pricing transparency and proper disclosure are maintained.

Four Key Benefits of Cash Discount Programs

1. Eliminate Credit Card Processing Fees to Increase Profit

Cash discount programs enable merchants to recover 100% of credit card processing costs, directly improving margins. For businesses processing $500,000 annually, that could mean $15,000–$20,000 in savings each year.

2. Improve Pricing Transparency & Customer Trust

By disclosing pricing clearly—showing both the card price and the cash discount—businesses build trust. Customers always appreciate knowing what they’re paying for.

3. Increase Cash Flow & Reinvest in Your Business

With fees reduced or eliminated, businesses retain more revenue per sale. Those savings can be redirected toward operations, staffing, or reinvestment.

4. Offer Payment Flexibility While Protecting Profit Margins

Customers maintain the choice of how to pay. Those who prefer cards still can, while cost-conscious customers can choose to save. Either way, the business controls its processing costs.

How Cash Discount Programs Work

Cash discount programs operate on a percentage-based structure, typically reflecting the merchant’s average credit card processing rates.

When a customer pays with cash, the system automatically calculates the appropriate discount, typically 3 to 4 percent of the transaction amount, and deducts it from the total.

To remain compliant, businesses must disclose the cash discount offer clearly and conspicuously before the transaction is completed. This is typically done through point-of-sale signage, which is often required by card brand rules and some state laws. Additional disclosures may include on-screen prompts or verbal communication, but signage is the most common and widely accepted method for compliance.

The cash discount transaction process typically follows three key steps:

- Customer chooses payment method: When paying, the customer selects credit, debit, or cash.

- Discount is applied for cash: If the customer pays with cash or debit, a discount is applied.

- Receipt reflects the discount: The cash discount is itemized clearly on the receipt.

Where Cash Discount Programs Work Best

Cash discounting is widely applicable but especially powerful in industries where:

- Transaction amounts are high

- Margins are tight

- Card usage is frequent

RevUpX supports cash discount programs in a wide range of industries, including:

Auto dealerships process high-value transactions where even a small percentage in credit card fees can translate into massive losses—sometimes $50,000 to $1,000,000 each year. RevUpX’s cash discount solutions help dealerships eliminate these fees entirely, meaning more revenue can go toward expanding inventory, growing your marketing efforts, or hiring staff. With no long-term contracts and guaranteed savings, dealerships of all sizes can turn credit card swipe fees into instant profitability—making it possible to invest back into your business and outpace competitors.

For home heating oil businesses, the challenge is balancing seasonal demand, high upfront costs, and slim margins. Every 3% lost to credit card fees eats directly into profits needed for equipment upgrades, vehicle maintenance, or staffing. RevUpX tailors cash discount programs to fuel dealers, budget providers, and regional distributors so they can keep more of every dollar. By eliminating processing fees, heating oil businesses gain a cash flow advantage to better manage deposits, emergency deliveries, and critical fleet costs—ensuring greater stability and growth throughout the year.

Moving and storage companies handle fluctuating workloads, significant deposits, and frequent card payments. Standard processing fees can quietly siphon off thousands of dollars monthly—money better spent on upgrading equipment, hiring movers, or navigating seasonal slowdowns. RevUpX delivers custom cash discount solutions that give movers and storage operators control over their margins by eliminating swipe fees, helping these businesses remain nimble and competitive while improving profit stability.

Waste management firms face constant cost pressures—from rising tipping fees to vehicle upkeep and customer churn. With card payments representing a major share of transactions, 3% or more in processing fees can add up to over $36,000 in lost revenue annually for a typical operation. RevUpX’s cash discount programs enable waste haulers, recyclers, and sanitary service providers to reclaim those dollars, funding upgrades, hiring, or expansion—all while keeping administrative headaches and contracts to a minimum.

Whether your company sells, rents, or services vehicles or handles logistics, freight, or passenger transport, card processing fees can clog cash flow fast. RevUpX specializes in supporting everything that moves: car, boat, and RV sales; auto glass shops; logistics and transport services; taxi and shuttle operators. Programs are designed for busy, on-the-go industries where high volumes and razor-thin margins demand a smarter approach. By keeping more from every transaction, you can reinvest in equipment, maintenance, and staff to drive lasting growth.

Wondering where your business fits? Talk to a member of our team.

How to Stay Compliant With Cash Discount Rules

Cash discount programs are legal in all 50 states, but there are specific rules to follow:

- Signage: Post clear notices at the entrance and point of sale indicating that listed prices include a card fee and a discount is available for cash.

- Receipts: Itemize the discount as a line item on receipts (e.g., “Cash Discount -$3.50”).

- Debit Cards: These qualify for the discount when processed as cash.

- Uniform Application: Discounts must apply consistently across all card brands and payment types.

Using a system designed for dual pricing ensures compliance and makes the customer experience seamless.

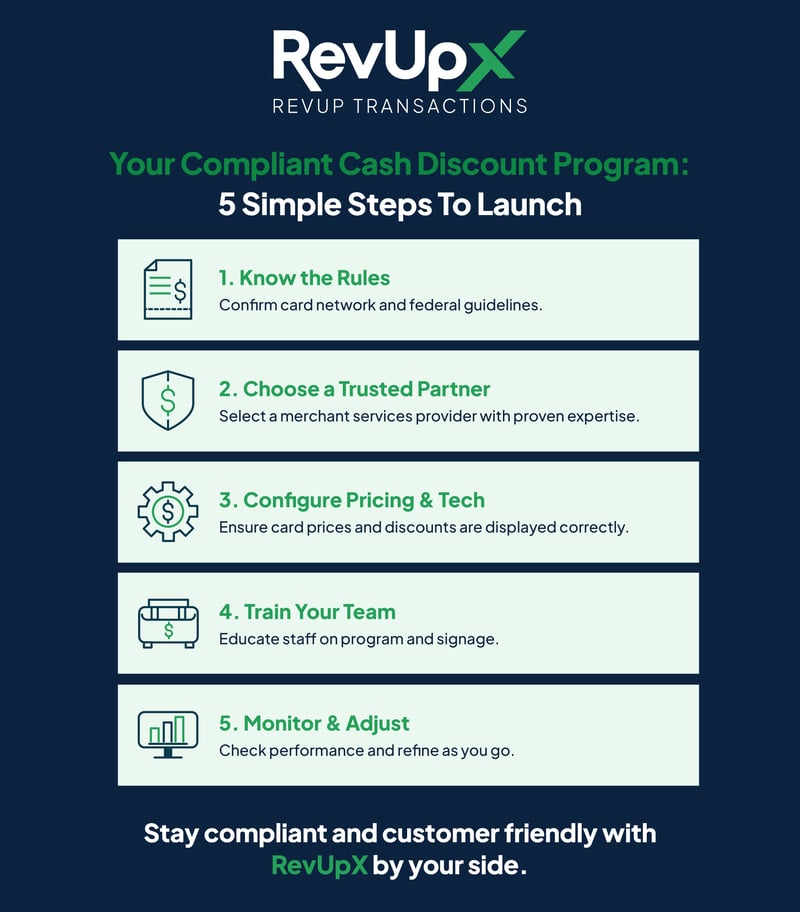

Step-by-Step Guide to Setting Up a Compliant Cash Discount Program

1. Understand the Rules & Regs

Start by reviewing card brand rules and federal guidelines to ensure your cash discount program is compliant. While cash discounts are allowed in all 50 states, they must be structured as true discounts—not disguised surcharges. Industry-specific considerations may still apply, so staying informed is essential.

2. Choose a Trusted Partner

Select a merchant services provider with proven expertise in cash discount program implementation. RevUpX specializes in deploying compliant cash discount solutions and offers end-to-end support—including compliance guidance, staff training, and system integration.

3. Configure Pricing & Technology

Configure your payment systems to apply the cash discount accurately and consistently at checkout. Ensure pricing is displayed correctly—reflecting card-inclusive prices with the discount applied only when customers pay with cash or eligible debit cards.

Verify that your systems and providers comply with PCI DSS (Payment Card Industry Data Security Standard) to protect cardholder data and maintain secure transactions.

Implement clear disclosure mechanisms—such as signage, digital prompts, or receipts—that explain the cash discount offer. Test all transaction flows to confirm pricing, receipts, and discounts function as intended and meet compliance standards.

4. Train Your Team

Ensure your team receives comprehensive training on program details, regulatory compliance, and effective customer communication. Post all mandatory signage in designated areas and develop clear customer materials that explain the program benefits and how it works.

5. Monitor & Adjust

Once your cash discount program is live, monitor key metrics like customer acceptance, transaction trends, and system performance. Pay attention to feedback from staff and customers, and watch for any operational issues. Use these insights to make informed adjustments that improve program effectiveness while ensuring ongoing compliance.

Cash Discount vs. Surcharge vs. Convenience Fee

Understanding the differences between cash discount, surcharge, and convenience fee programs is essential for choosing the right payment strategy. While all three can help offset processing costs, surcharge and convenience fee programs come with distinct rules and limitations.

The sections below explain how each model works and when to use it.

What Are Surcharge Programs & How Do They Differ from Cash Discounting?

Unlike cash discount programs that offer a discount for paying with cash or debit, surcharge programs add a fee to credit card transactions to cover processing costs. This approach is subject to card network rules and is not permitted in all states.

What Are Convenience Fees and How Do Businesses Use Them?

Convenience fees are flat charges applied when customers use nonstandard payment channels, such as paying online or by phone instead of in person. The fee stays the same regardless of purchase amount and must comply with specific card network rules. They’re commonly used by government agencies, utilities, schools, and toll services.

How to Address Cash Discount Program Concerns

Businesses exploring cash discount programs often have questions about setup, compliance, and day-to-day operations. Key questions include:

Will customers be upset by a cash discount program?

Clear communication is key to customer acceptance.

Make sure your signage, receipts, and staff messaging explain that listed prices include card processing costs, and that customers can save by paying with cash. Emphasize transparency and choice: the discount is an incentive, not a penalty. Train staff to answer questions confidently and reassure customers that they’re not being charged extra, but instead offered a way to pay less.

Is a cash discount program hard to set up?

Setup is simple with the right provider.

A knowledgeable merchant services partner, such as RevUpX, can streamline implementation by handling system configuration, signage, staff training, and compliance checks. Look for providers experienced in dual pricing who can ensure your hardware and software apply the discount correctly and consistently from day one.

How do I stay compliant over time?

Periodically review how your cash discount program is functioning—from signage and receipts to system accuracy and staff communication. Stay updated on any changes to card network rules or industry guidelines, and partner with a provider such as RevUpX, that can help you adjust quickly if requirements shift.

How do I handle integration with my existing systems?

A qualified cash discount provider will evaluate your existing hardware and software for compatibility, then make any necessary upgrades or adjustments. Many systems can be configured for dual pricing without major disruption, ensuring a smooth transition and consistent customer experience.

Partner with RevUpX for Success

Cash discount programs offer a proven way for businesses to reduce credit card processing costs while preserving customer choice at checkout. With swipe fees continuing to rise, offsetting those expenses through compliant, customer-friendly strategies has never been more important.

Success starts with understanding the rules, using the right systems, and partnering with an experienced provider like RevUpX. Our team specializes in compliant cash discount implementation—offering everything from system setup to staff training and ongoing support.

By following the step-by-step implementation guide and focusing on transparency and customer education, businesses can roll out a cash discount program that protects margins without sacrificing satisfaction.

Contact RevUpX today to learn how we can help you launch a compliant, effective cash discount program tailored to your business.