The Complete Guide to Merchant Processing: Everything You Need to Know

Explore the essentials of merchant processing—from payment types to pricing models, compliance, and trends—in this comprehensive U.S.-focused guide.

Merchant processing refers to the services and technology that enable businesses to accept electronic payments (such as credit cards, debit cards, etc.) from customers. It encompasses the credit approval process and serves as a pipeline for transferring funds from customers to merchants securely and efficiently.

Efficient payment systems are crucial for businesses seeking to manage costs, streamline operations, and enhance the customer experience.

This guide explores key concepts, payment types, fee structures, compliance requirements, security practices, and how to choose the right vendor within the U.S. market.

Key Takeaways

- Payments Are Strategic: Merchant processing is more than tech—it drives revenue, improves operations, and shapes customer experience.

- Understand the Fees: Interchange and assessment fees are fixed. Processor fees vary—and that’s where businesses can save.

- Zero-Fee Models Are on the Rise: Surcharging and cash discounting are increasingly popular ways to offset processing costs legally and transparently.

- Security and Compliance Matter: PCI compliance, tokenization, and fraud tools aren’t optional—they protect your business and customer trust.

- RevUpX Offers Full-Service Solutions: RevUpX provides merchant services and zero-fee credit card processing, with expert guidance and full compliance support.

Background

Modern merchant processing emerged with the rise of electronic payments in the 1970s and 1980s, expanding rapidly in the 1990s with the advent of e-commerce.

It became essential as consumer payment habits shifted from cash to cards and digital options. Today’s systems are more secure, regulated, and integrated than ever, helping businesses streamline operations and reduce fraud.

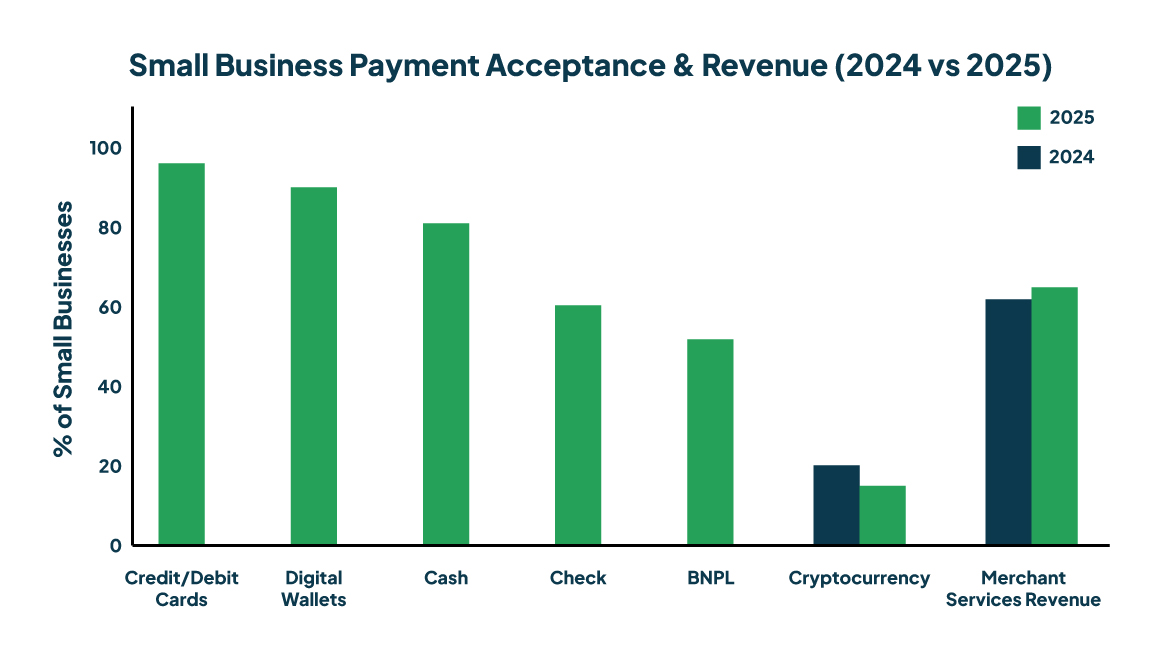

Recent data from the J.D. Power 2025 U.S. Merchant Services Satisfaction Study, SM highlights the dominance of card-based and digital payment methods at the point of sale—and underscores the central role merchant services play in small-business revenue.

Credit Card Processing: Payment Types and Acceptance Methods

Payment types refer to the methods used for payment, such as credit cards, debit cards, ACH transfers, digital wallets (e.g., Apple Pay), or Buy Now, Pay Later (BNPL) options.

Payment channels refer to the methods by which payments are made, including in-store transactions via a point-of-sale (POS) terminal, online purchases through an e-commerce site, mobile app transactions, and mail-order or telephone-order (MOTO) transactions.

Quality payment processors (more on that below) support a variety of types and channels, ensuring customers can pay in the way they prefer while helping businesses optimize speed, cost, and convenience.

How Credit Card Processing Works: Players and Transaction Flow

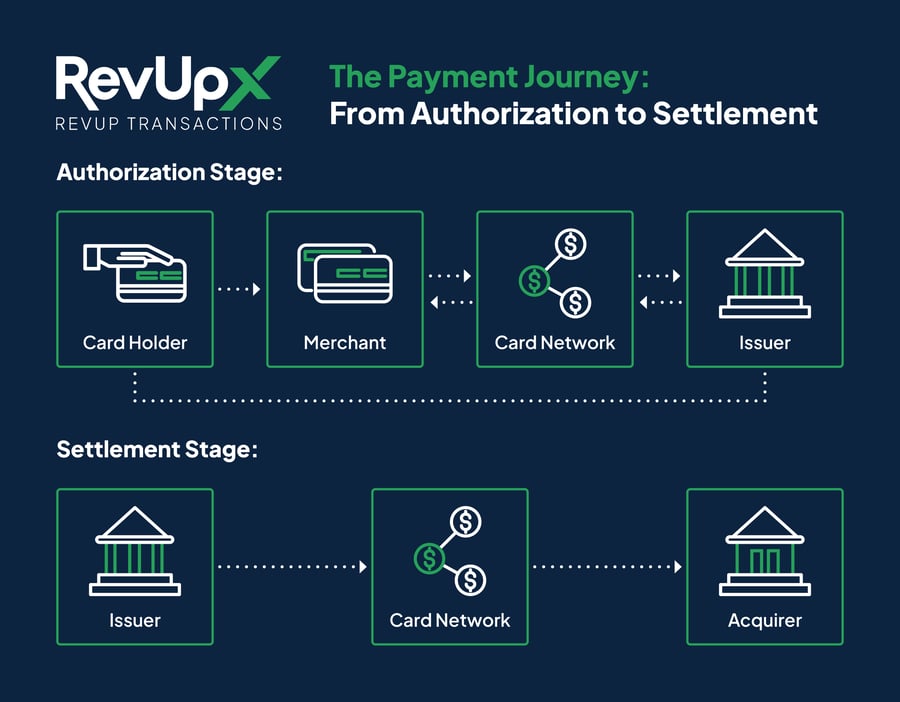

Every card payment goes through two core stages: authorization and settlement.

- Authorization occurs in real time, when the cardholder’s bank (the issuing bank) approves or declines the transaction. The end-to-end process generally happens in seconds.

- Settlement occurs later, when funds are transferred from the issuing bank to the merchant’s account via the acquiring bank. This can take one to three business days on average.

Who’s Involved in Every Card Transaction?

Both stages of a card transaction involve multiple parties, each with a distinct role in facilitating the transfer of data and funds. Here’s who does what:

- Cardholder: The customer who initiates a purchase using a credit or debit card.

- Merchant: The business that accepts the card and submits transaction data across the payment processing chain for approval and payment.

- Payment Processor: Routes transaction data securely to/from the card networks during the authorization stage and may assist in the settlement stage if it manages the merchant account or distributes funds for the acquirer.

- Card Network (e.g., Visa, Mastercard): Routes data between processors, issuing banks, and acquiring banks, while enforcing security and compliance.

- Issuing Bank (Issuer): The cardholder’s card-issuing bank. Approves or declines transactions and transfers funds for approved purchases.

- Acquiring Bank (Acquirer): The merchant’s bank receives funds for approved transactions from the issuer to deposit into the merchant’s account.

Processing Costs Explained: Fees and Pricing Models

Processing Fees

When a customer pays with a credit or debit card, the merchant pays fees to process the transaction. Fees are made up of three main components:

- Interchange fees, paid to the issuing bank

- Assessment fees, paid to the card network

- Processor fees, paid to the payment processor

Together, these fees typically range from 1.5% to 3.5% of the transaction amount, with the exact rate depending on factors like card type, transaction method, and processor pricing.

Interchange and assessment fees are relatively fixed while processor fees are often negotiable and vary widely, depending on your provider and pricing model.

Interestingly, assessment fees are also set by the card networks, which can be viewed as controversial since the networks both define the rules and profit from them.

Processor fees may include hidden or bundled costs such as batch processing, PCI compliance, chargeback fees, and equipment leasing. Monthly minimums, annual fees, and early termination penalties can also catch merchants off guard.

To dig a little deeper, check out RevupX’s blog The Hidden Costs of Traditional Credit Card Processors: What Auto Dealers Need to Know一featuring insights relevant to merchants across industries, not just auto dealerships.

A single sale processed through a credit card can include multiple (hidden) charges beyond the quoted processing rate, directly impacting merchant profitability.

Pricing Models

Payment processors typically employ one of four pricing models, which vary in terms of transparency, predictability, and fee structure—whether as markups over interchange, bundled tiers, flat rates, or monthly subscriptions.

Cost Sharing Models

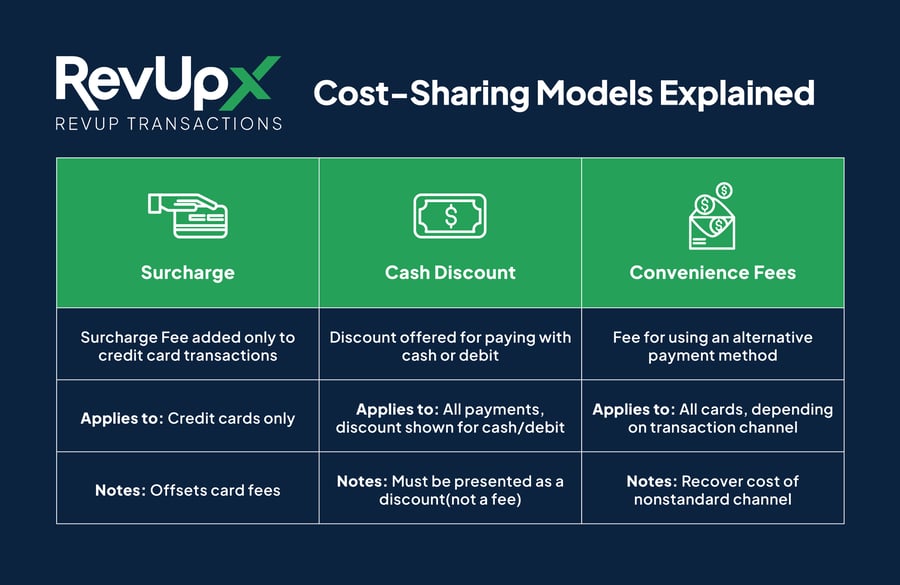

In response to rising payment processing costs, many U.S. merchants are exploring zero-fee credit card processing through pricing models that help offset these expenses. Approaches such as surcharging, cash discounting, and convenience fees offer merchants more flexibility managing costs while encouraging preferred payment behaviors. A brief overview of each solution follows

Surcharge Programs

A surcharge program adds a percentage fee to credit card transactions to cover the cost of processing, allowing merchants to reduce or eliminate credit card processing fees by directly passing them to customers who choose to pay with credit cards. Surcharges cannot be applied to debit card transactions and are currently prohibited in Connecticut and Massachusetts.

According to the J.D. Power 2025 U.S. Merchant Services Satisfaction Study, SM 34% of merchants now add a retail customer surcharge for credit card transactions, a significant increase from just a few years ago, when comparable studies showed fewer than one in four merchants surcharging.

Cash Discount Programs

With a cash discount program, prices are set at the credit card price, and customers who pay with cash receive a discount. This model is legal in all 50 states, can be applied to all payment types including debit cards, and is often viewed positively by customers as a discount rather than a fee.

Convenience Fees

Convenience fees represent another cost-sharing approach, typically implemented as a fixed flat fee for using specific, non-standard payment methods. While less common in traditional retail environments, they’re frequently used in entertainment, utility, and government sectors.

Implementation Considerations

Successful implementation requires clear communication, proper signage, and ongoing compliance with regulations.

Specialized merchant services providers such as RevUpX offer expertise in zero-fee credit card processing programs, helping businesses navigate the complexities of surcharge and cash discount implementation while ensuring full regulatory compliance.

Compliance & Security

While processors and acquirers help facilitate secure payments, merchants are ultimately responsible for protecting cardholder data and ensuring compliance with relevant requirements. Here’s what that involves:

PCI DSS Compliance

Accepting card payments comes with strict rules and responsibilities. At the core is the Payment Card Industry Data Security Standard (PCI DSS)—a mandatory framework designed to protect cardholder data and prevent fraud. Whether you’re a small business or enterprise merchant, maintaining PCI compliance helps minimize liability and safeguard customer trust.

End-to-End Data Protection

Security also involves your payment environment. This includes tokenization (replacing card data with non-sensitive tokens), encryption, and secure payment gateways that protect data in transit. Fraud tools, such as address verification (AVS), 3D Secure, and velocity checks, add further layers of protection.

Chargebacks & Disputes

While often viewed as customer service issues, chargebacks and dispute resolution processes also have compliance implications. Mishandling them can result in increased fees or even termination of the merchant account.

Processors and acquirers share the responsibility, but the merchant is ultimately accountable. As small businesses encounter more fraud-related challenges, data security and guidance during disputes have become critical expectations from merchant services providers.Essential Payment Technology: Tools, Analytics, and System Integration

POS Systems and Payment Hardware for Businesses

To accept payments, merchants require the right combination of hardware and software, including point-of-sale (POS) terminals, virtual terminals, mobile card readers, and payment gateways for online transactions.

These tools are typically provided by the payment processor or acquiring bank, often bundled into their service offerings or available through integrated partners.

Transaction Analytics and Business Intelligence

Beyond processing payments, robust reporting tools enable merchants to track transactions, monitor fees, and identify trends that impact their revenue. Look for processors that offer real-time dashboards, customizable reports, and clear breakdowns of charges, settlements, and chargebacks.

System Integration: Connecting Payments to Your Business Operations

Integration with your accounting, inventory, or CRM systems can streamline operations and reduce manual data entry, transforming your payment infrastructure into a valuable business performance asset.

However, deep integration can also introduce risk. Widespread outages, such as the CDK Global cyberattack, exposed how dependent businesses can become on interconnected systems. Selecting reliable, well-secured partners and establishing contingency plans is crucial.U.S. vs. Global Processing

Card processing fundamentals are similar worldwide, but international payments involve added complexity, such as currency conversion, regional compliance rules, and support for local payment methods.

While U.S. merchants typically work with domestic acquirers and follow PCI DSS, global processing requires navigating frameworks such as PSD2 in Europe or Australia’s Consumer Data Right (CDR).

If you plan to expand internationally, partnering with a processor experienced in regional compliance is crucial.

The Future of Payment Processing: Trends and Innovations

Merchant services are rapidly evolving, fueled by advances in AI, real-time infrastructure, and consumer payment preferences. The five emerging trends discussed below show how these innovations are reshaping the industry:

Smarter Security & UX with AI

Artificial Intelligence (AI) is transforming merchant services by improving fraud detection, risk management, and personalization. Visa alone reports over 100 AI models in production, powering more than 100 tools in these areas.

Merchants also use AI for smart routing, chatbots, and tailored offers at checkout. In 2024, adoption has shifted from early promise to real-world results, creating faster, safer, and more intelligent payment experiences.

Real-Time Payments & Instant Bank Transfers

Real-time payments are gaining traction in the U.S. thanks to FedNow and The Clearing House’s RTP network, which provides the infrastructure for instant bank-to-bank transfers.

Although these payments made up only 1.5% of U.S. volume in 2023, transactions grew 25% from 2022 to 3.5 billion. With a projected 32% annual growth, the U.S. is on pace to reach 14 billion transactions by 2028.. Merchants favor the speed and lower cost of account-to-account payments.

Expansion of Buy Now, Pay Later Finance

Buy Now, Pay Later (BNPL) continues to expand, with 54% of U.S. small businesses now offering it. Services like Affirm and Klarna let customers split purchases into interest-free installments. Consumer use is also on the rise—15% of Americans used BNPL in 2024, up from 12% two years prior.

Surge in Contactless Payments & Digital Wallets

Contactless payments—including tap-to-pay cards and mobile wallets like Apple Pay and Google Pay—are now mainstream. In the U.S., 88% of small merchants accept digital wallets, and 62% of businesses used them in 2023, up from 47% in 2022, highlighting rapid post-pandemic adoption for faster, touch-free checkouts.

All-in-One Payment Platforms and Commerce Integration

Merchants are adopting unified commerce platforms that integrate in-store, online, and mobile payments, enabling seamless transactions across all channels.

All-in-one systems such as Shopify or Toast combine POS with features like inventory, analytics, and loyalty tools—reducing the need for multiple vendors and streamlining operations. Many now turn to software providers over traditional payment processors.

You can find even more trends (with a focus on specialty industries) in our blog, The Future of Payment Processing: Trends Across Specialty Industries.

Choosing a Merchant Services Provider

Selecting the right merchant services provider requires evaluating several key factors beyond just pricing.

Look for transparent fee structures without hidden costs, robust security features including PCI compliance support, and reliable customer service with dedicated account management.

Consider whether the provider offers the payment types and channels your customers prefer, from traditional cards to digital wallets and contactless payments.

Integration capabilities with your existing systems, implementation support, and industry-specific expertise can also be important.

Providers such as RevUpX offer expert merchant services, along with zero-fee credit card processing and tailored solutions that provide comprehensive compliance support, helping businesses navigate complex payment requirements while maximizing cost savings.

Making Payment Processing Work for Your Business

Merchant processing has evolved from a simple transaction service to a strategic business tool that impacts everything from customer experience to operational efficiency.

Understanding the key components—from payment types and fee structures to security requirements and emerging trends—empowers businesses to make informed decisions that drive growth and profitability.

The right merchant services provider can transform payment processing from a cost center into a competitive advantage.

Whether you’re exploring zero-fee credit card processing, implementing new payment channels, or navigating compliance requirements, expert guidance makes all the difference.

Ready to Eliminate Your Credit Card Processing Fees?

Don’t let processing costs drain your profits.

RevUpX’s zero-fee credit card processing and tailored merchant services solutions help businesses across industries recapture thousands in annual savings while maintaining full compliance.

Our team of payment processing experts will analyze your current setup, identify cost-saving opportunities, and implement a customized solution that works for your business—with comprehensive support every step of the way.

Contact RevUpX today to discover how much you could be saving on every transaction.