Payment methods have undergone significant changes in recent years. According to the Federal Reserve’s 2024 Diary of Consumer Payment Choice, credit cards (32%) and debit cards (30%) together now account for more than 60% of monthly payments by U.S. consumers. This digital payment dominance means that understanding processing fees isn’t just helpful—it’s essential for maintaining healthy profit margins.

At RevUpX, we help businesses decode these costs and implement strategies to keep more of every transaction.

Even small differences in processing rates compound significantly over time. A business processing $100,000 monthly with a 0.5% rate difference pays an additional $6,000 annually. For high-volume operations, these costs can reach tens of thousands of dollars, making fee optimization a critical component of financial management.

Key Takeaways

- Card payments dominate consumer spending. Credit and debit now make up over 60% of U.S. payments, so managing fees is critical to protecting margins.

- Interchange is the largest cost driver. The largest share of fees goes to issuing banks, with rates varying by card type, method, and bank.

- Small changes create big savings. Collecting address data, settling promptly, and reducing chargebacks help keep rates lower.

- Every industry has unique opportunities. From dealerships to waste management, targeted tactics like least-cost routing or EMV deliveries can reduce costs.

- Partnering with the right provider makes all the difference. RevUpX brings 25+ years of expertise, zero-fee programs, and ongoing optimization to keep savings compounding.

What’s on Your Processing Statement

Understanding your processing statement starts with recognizing the three core components that make up your total fees:

Interchange Fees

Interchange fees represent the most significant portion of your costs, which are paid directly to the card-issuing banks, such as Chase, Bank of America, or Wells Fargo. However, they can vary significantly depending on which bank issued your customer’s card.

For instance, according to the Federal Reserve, debit card fees at large banks一which are capped by federal rules一averaged about 23 cents per transaction in 2023. At smaller banks and credit unions, which aren’t capped, the average was much higher at around 51 cents per transaction.

To put that variance into perspective: if you process 1,000 debit transactions a month, that difference alone could add up to about $280 more in fees, purely based on the customer’s bank.

Network Assessment Fees

Network assessment fees go to card networks such as Visa, Mastercard, American Express, and Discover. These fees cover network operations and are set by each brand according to its published fee schedules.

Processor Service Fee

Processor fees represent your payment processor’s margin for handling transaction logistics, customer service, and technology infrastructure. These components appear differently depending on your pricing structure:

- Flat-rate pricing bundles all fees into one percentage, offering simplicity but potentially higher costs for high-volume merchants.

- Tiered pricing separates transactions into qualified, mid-qualified, and non-qualified categories.

- Interchange-plus pricing provides the most transparency, showing exact interchange costs plus the processor’s markup.

For a closer look, check out RevUpx’s blog, The Hidden Costs of Traditional Credit Card Processors: What Auto Dealers Need to Know.

What Drives Your Payment Processing Costs

Several factors influence your processing fees, and understanding these variables can help optimize costs:

- Card type and ticket size significantly impact interchange rates. Debit cards typically cost less than credit cards, while premium rewards and corporate cards carry higher fees. Large transactions may trigger different rate structures, making it important to understand how your average ticket size affects overall costs.

- Transaction method creates substantial rate differences. Card-present transactions with chip readers generally receive the lowest rates, while manually entered or online transactions face higher “card-not-present” fees due to increased fraud risk.

- Merchant Category Code (MCC) determines your industry risk profile and associated interchange rates. Different industries receive different treatment based on historical chargeback and fraud patterns.

- Risk signals and processing quality affect your rates through Address Verification Service (AVS) and Card Verification Value (CVV) checks. Higher authorization rates and lower chargeback ratios can help maintain favorable pricing. For example, collecting the full billing address and CVV on deposits makes approvals smoother and disputes less likely—keeping you out of higher-cost risk fees.

- Timing and settlement influence costs through prompt capture requirements. Delayed settlements or authorization-to-capture timing issues can result in downgrades to higher-cost categories.

Industry Spotlights: Quick Wins by Vertical

Different industries face unique processing challenges, but targeted strategies can help deliver meaningful savings. Below are a few industry-specific examples that show how simple adjustments can cut costs and improve processing efficiency:

Auto Dealerships

Auto dealerships handle high-ticket transactions, making rate optimization critical. Encourage debit card usage when appropriate, as the savings on large transactions can be substantial. Avoid transaction downgrades by ensuring proper settlement timing, and consider partial deposits versus full swipes to minimize exposure and potentially reduce fees on larger purchases.

Moving Companies

These businesses frequently process card-not-present transactions and deposits, making fraud prevention essential. Implement AVS and CVV verification consistently, obtain written authorizations for large deposits, and capture transactions promptly to avoid downgrades.

Waste Management Companies

Waste management businesses rely heavily on recurring billing, making account updater services and tokenization valuable investments. Reduce retry attempts that can trigger higher fees, and monitor chargebacks closely to maintain favorable processing rates.

Home Heating Oil Providers

These merchants experience seasonal spikes and frequently process phone orders. Batch transactions the same day to help avoid late settlement fees, collect complete address data for better interchange qualification, and consider on-site EMV processing for delivery payments.

The same principles apply across many other industries: optimize the details that drive interchange and you’ll likely see the savings.

How to Lower Your Processing Fees (Checklist)

Reducing processing costs requires a systematic approach targeting each fee component. While every business is different, the core strategies are broadly the same.

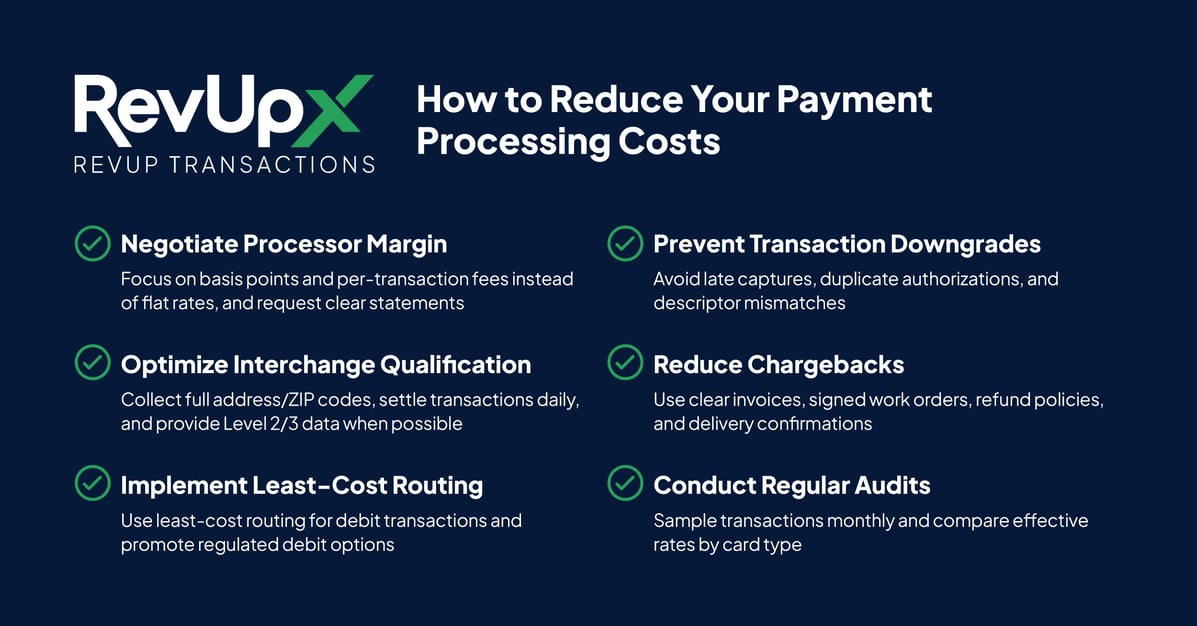

Here is a checklist you can use to identify savings opportunities and avoid unnecessary fees:

- Negotiate processor margin by focusing on basis points and per-transaction fees instead of flat headline rates. Request clear statements that break out interchange, assessments, and processor fees so you can see the true cost structure.

- Optimize interchange qualification by collecting complete addresses and ZIP codes, settling transactions the same day, and sending Level 2/3 data一additional invoice details一on business and government card payments to qualify for lower rates.

- Implement least-cost routing for debit transactions when available, and encourage regulated PIN debit or Visa debit on appropriate transactions to access lower interchange rates.

- Prevent transaction downgrades by avoiding late captures, voiding duplicate authorizations, and fixing descriptor mismatches that can trigger higher-cost categories.

- Reduce chargebacks through clear invoices, signed work orders, transparent refund policies, and delivery confirmations. Lower chargeback ratios help maintain favorable processing agreements.

- Consider surcharging or cash discounting when compliant with state and network rules, ensuring clear disclosure and proper implementation to avoid penalties.

- Conduct regular audits by sampling transactions monthly, comparing effective rates by card type, and identifying anomalies that require processor attention.

Common Questions & Pitfalls

Even business owners who watch their fees closely often run into the same recurring questions. Why did my rate suddenly go up? Can I nudge customers toward cheaper payment types? Is flat-rate pricing really the best deal? Below are some of the most common pitfalls and how to think about them.

Why did my processing rate suddenly increase?

Rate changes typically result from transaction mix shifts, increased downgrades, or new processor add-on fees. Regular monitoring helps identify the specific cause and appropriate response.

Can I encourage customers to use debit cards?

Yes, you can provide clear signage about payment options, but avoid discriminatory practices and ensure compliance with network rules regarding payment steering.

Is flat-rate pricing always simpler?

Flat-rate pricing offers predictability but may not provide the best value for high-volume merchants who can benefit from interchange-plus transparency and optimization opportunities.

Take Control of Your Processing Costs

Effective payment processing management prioritizes transparency and optimization over simply chasing the lowest advertised rates. Understanding your statement components, optimizing transaction handling, and conducting regular reviews create sustainable cost reductions that compound over time.

The key to long-term success lies in working with a processor who provides transparent pricing, industry expertise, and ongoing support for optimization efforts. When processing costs are properly managed, businesses can focus resources on growth and customer service rather than absorbing unnecessary fees.

Partner With RevUpX for Payment Solutions

RevUpX brings more than 25 years of merchant services expertise to help businesses optimize payment processing costs through strategic partnerships with industry leaders Fiserv and CardConnect.

Our zero-fee credit card processing programs use fully compliant surcharge and cash discount solutions to eliminate processing fees. We specialize in serving margin-sensitive industries such as auto dealerships, waste management, moving and storage, home heating oil, and transportation.

With RevUpX, you get transparent pricing with no hidden fees, industry-specific expertise, and dedicated support that ensures your system runs smoothly from day one and continues to perform as your business grows.

Ready to take control of your payment costs? Contact RevUpX today for a free analysis of your current processing fees. We’ll show you where savings can be made and design a customized solution that helps protect your margins and improve profitability.